Importing K-1 Data

Following are instructions for importing K-1 information from 1041, 1065, and 1120S returns into new 1040, 1041, 1065, and 1120S returns.

New Returns

To import K-1 information into a new 1040 return:

- Complete a 1041, 1065, or 1120S return, including the appropriate K-1(s).

See Creating Returns.

- Create a new 1040, 1041, 1065, or 1120S return.

- With the new return open, click the Returns menu.

- Expand the Import Data fly-out menu; then, select K-1 Data.

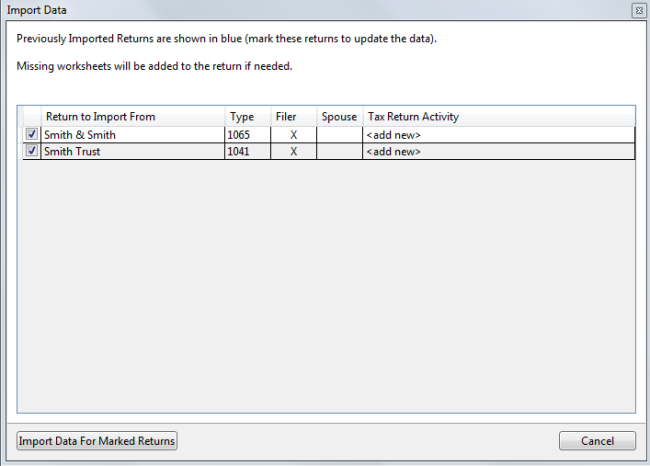

Import Data dialog box

All returns are checked by default. If you do not want to import data from one or more of these returns, deselect the check box.

- Click the Import Data For Marked Returns to import the K-1 Data.

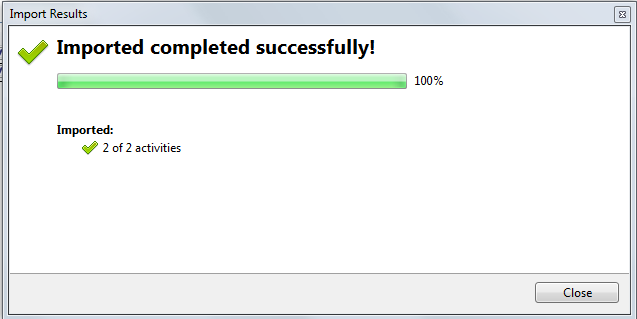

Import Results progress dialog box

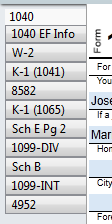

The information from the matching 1041, 1065, or 1120S return(s) is added to the applicable K-1 Input Worksheet(s) in the new return. The corresponding forms are added to the new return:

If you make subsequent adjustments to K-1 data on 1041, 1065, and 1120S returns, the system will notify you of changes when you open the corresponding new return. At that time, you'll be given the opportunity to update K-1 information.

Messages You May Receive

The SSN and/or EIN must be entered on the new return in order to begin importing data. If it is not in place, you'll receive a message dialog box. You'll also be notified if the system cannot locate any 1041, 1065, or 1120S returns with SSNs or EINs corresponding to the 1040 return.

Updating K-1 Information on an Existing Return

To update imported K-1 information on an existing return:

- Make the changes to the Sch K-1 form in the 1041, 1065, or 1120S return.

- Open the existing return.

- With the return open, click the Returns menu.

- Expand the Import Data fly-out menu; then, select K-1 Data.

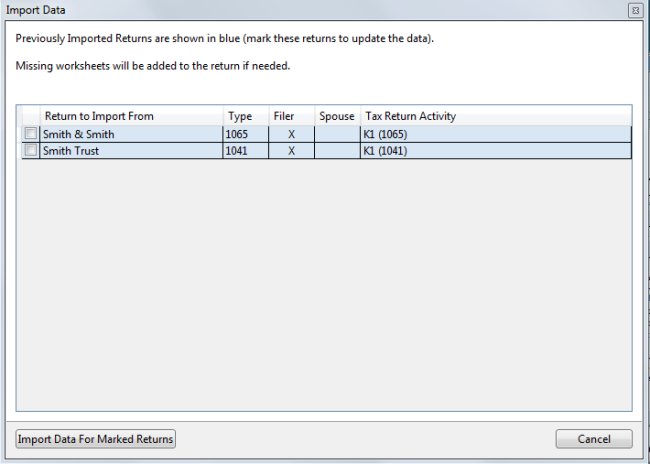

Import Data dialog box

Previously imported returns are shown in blue.

- Select the check boxes for the returns you want import.

- Click Import Data For Marked Returns.

ATX loads the new data into the 1040 return.

Opening a Return When Associated K-1 Data Has Changed

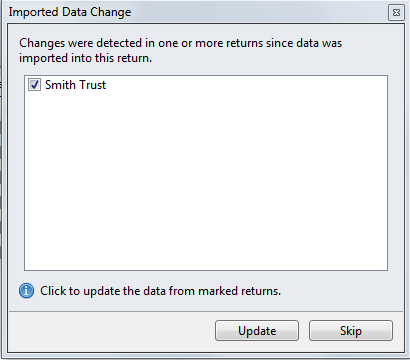

Imported Data Change dialog box

Click Update to import the changed data into the destination return, or click Skip to open the return without updating the K-1 data.

Unavailable Source Returns or Forms Within Source Returns

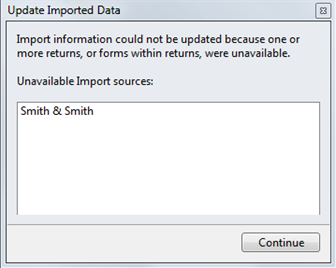

Update Imported Data message

Click Continue to open the return without updating the data.

Amended Source Returns

If a source return is amended, both the original and the amended return appear in the Import Data Change dialog box. Select the Amended return and click Update.

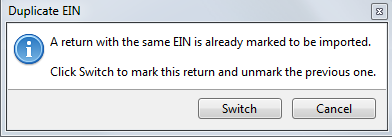

If you try to select the original source return, you'll receive a Duplicate EIN message:

Duplicate EIN message

Click Switch to select the Amended return instead.

See Also: